Financial markets did not offer a warm welcome to Gabriel Boric, Chile’s newly elected leftist president. After Boric’s resounding victory in December, average stock prices on the Santiago exchange fell by more than 6 percent — and the Chilean peso lost about 3 percent against the U.S. dollar.

Chile isn’t the only country where markets reacted adversely to leftist electoral victories. We’ve seen similar drops in France, Brazil and Peru, among other places. My analysis of more than 750 global elections helps explain why.

When the left wins, stocks plummet

Boric’s victory wasn’t a complete surprise, so some of the negative effect on stock prices likely occurred in the weeks leading up to the election, as market participants digested election polling data and began factoring in a likely leftist win. Economists call this “anticipation effects” — to some degree, investors trade securities in anticipation of how they think the election will turn out.

How does this calculus work? Assume, for example, that before election day investors attributed a 60 percent likelihood to Boric’s victory. Under this assumption, my calculations using standard asset valuation formulas suggest that Chilean share prices would have been 16 percent higher, and the peso about 7 percent more valuable, if right-wing candidate José Antonio Kast had won instead.

To be sure, specific features of this election, like the candidates’ different approaches toward mining, might help explain the market drop. But the negative effect of left-wing electoral victories on equity prices is a broader phenomenon that can be detected across national elections around the world and in different historical periods.

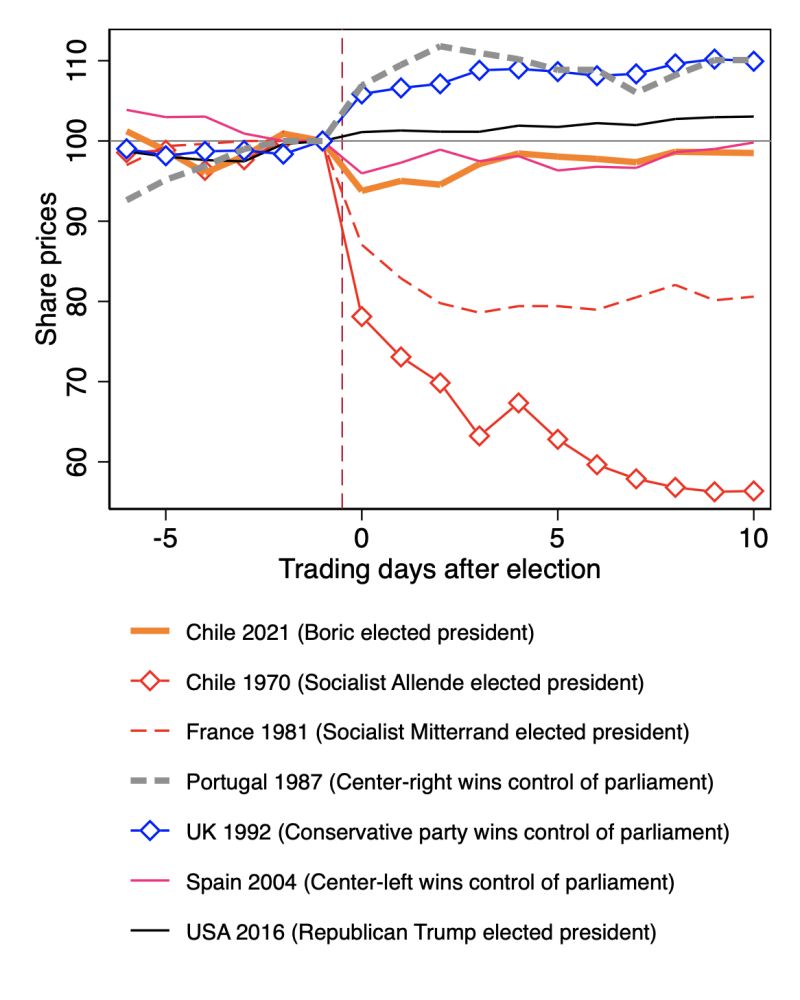

The figure below compares what just happened in Chile to other notable examples, normalizing share prices to equal 100 the day before the election. The surprise victories of Salvador Allende (Chile, 1970) and François Mitterrand (France, 1981) caused veritable market crashes. Boric’s effect almost pales in comparison.

Stock market prices around selected elections

How I did my research

So how do we know that these market reactions stem from investors’ views about leftist winners? In my research I went beyond handpicked examples to analyze data from more than 750 national elections since 1945.

The impact of these elections on markets is made hard to detect by the anticipation effects described above. What’s more, market movements affect political developments — a financial crash can undermine the reelection prospects of an incumbent, for instance. As causal effects run both directions, simple statistical associations are hard to interpret.

To overcome these difficulties, I focused on close elections, which tend to be less predictable and associated with more balanced market conditions. Comparing elections the left closely won and closely lost helps isolate the causal effect of electoral results.

I discovered a clear trend: One month after a center-left victory at the polls, share prices are about 13 to 15 percent lower than they would have been with a conservative victory.

Of course, these results summarize averages across many elections in different times and places. The market reaction tends to be much stronger when left parties propose social democratic and interventionist policies, and weaker (although still present) when they embrace a neoliberal approach.

And the impact is generally stronger in developing countries, which tend to have fewer protections for property rights and weaker checks and balances constraining government action. In the United States, where the centrist and usually pro-business Democratic Party occupies the left of the political spectrum, researchers note a significant but smaller effect: On average, electing a Republican president raises equity valuations by 2 to 3 percent.

Investors anticipate policy effects

The negative reaction of financial markets to left-leaning politics suggests that political coalitions can have divergent effects on the economy and the distribution of income. This runs counter to a major theory of elections — the “median voter theorem,” which expects electoral competition to force political parties to adopt the same centrist positions. If this were true with respect to economic policy, electoral results wouldn’t impact markets much, because investors would expect left-leaning and more conservative parties to implement similar platforms.

Just because investors react negatively when they think left-wing redistributive and interventionist policies are imminent, that doesn’t mean that these policies hurt economic prosperity. Share prices just reflect investors’ expectations about future profits: Other things equal, political changes that could allow workers and social policies to command a higher share of the national income are likely to hurt the stock market, even when no shrinking of the pie is involved.

However, downturns in financial markets can torpedo the left’s economic programs and electoral prospects. For example, in 2002, Brazilian financial markets trembled at the prospect of Lula’s ascent to power. The leftist candidate then shifted to a more investor-friendly economic agenda to restore financial stability and reassure voters.

Markets constrain politics

How does an adverse reaction of financial markets pose serious challenges to a left-leaning, pro-labor government?

First, nervous shareholders might decrease their consumption, depressing production and employment. And, second, the currency depreciation that’s often triggered by left-wing victories might fuel inflation and decrease real incomes, especially for the less well-off.

A third possibility is that voters interpret post-election market jitters as a mark of economic incompetence, giving an early hit to the popularity of the incoming administration. What’s more, market turmoil in anticipation of a possible leftist victory can make that victory harder to achieve.

Fourth, the reduction in expected profitability signaled by the stock market decline might reduce incentives for firms to invest. This channel might be the most consequential, given the key role investment plays in economic growth. However, existing evidence suggests that expectations about consumer demand (which could get a boost from redistributive policies) are much more important than expected profitability for firms’ investment decisions.

These effects highlight how markets can constrain democratic politics, as in the case of Lula’s centrist turn in 2002. Chile in 2022 is no exception: Markets will constrain Boric’s ability to push through progressive reforms. Judging from the cabinet he just appointed, the young president-elect fully understands this. In a classic move to reassure markets, he entrusted the finance ministry to the country’s central banker Mario Marcel, an independent technocrat with a solid reputation in financial circles.

Daniele Girardi (@DanieleGirardi_) is an assistant professor of economics at the University of Massachusetts Amherst and associate editor at the Journal of Economic Surveys and the Review of Social Economy. His research focuses on the relation between political and economic institutions.