Mike, a gregarious ex-rugby player who now burns excess energy by putting in miles on a road bike, is not ready to retire. Yet his job in fintech — which he began in April 2020, a week into the UK’s first Covid lockdown — has proved radically different from the one he signed up for.

Mike, a gregarious ex-rugby player who now burns excess energy by putting in miles on a road bike, is not ready to retire. Yet his job in fintech — which he began in April 2020, a week into the UK’s first Covid lockdown — has proved radically different from the one he signed up for.

Working at senior level in business development, he used to enjoy spending days on the road meeting clients. Long stints of wall-to-wall Zoom calls left him stultified yet still buzzing and unable to sleep in the small hours.

“If my children sat at a screen for 10 to 11 hours a day, I’d lock it in a cupboard”, says Mike, who asked that his surname not be used. “All the fun has been sucked out of the job”.

At the same time, a friend’s sudden death with Covid symptoms and his wife’s progressing MS condition made him more conscious of mortality. “On your grave, ‘Mike worked hard’ — it’s not one you see”, he says. “I want to get some time in my life where I stop and think”.

So at the age of 56, he has handed in his notice and is weighing up options ranging from part-time consulting to training as a gardener — one of countless people across the developed world for whom Covid has been a catalyst to reassess their working lives.

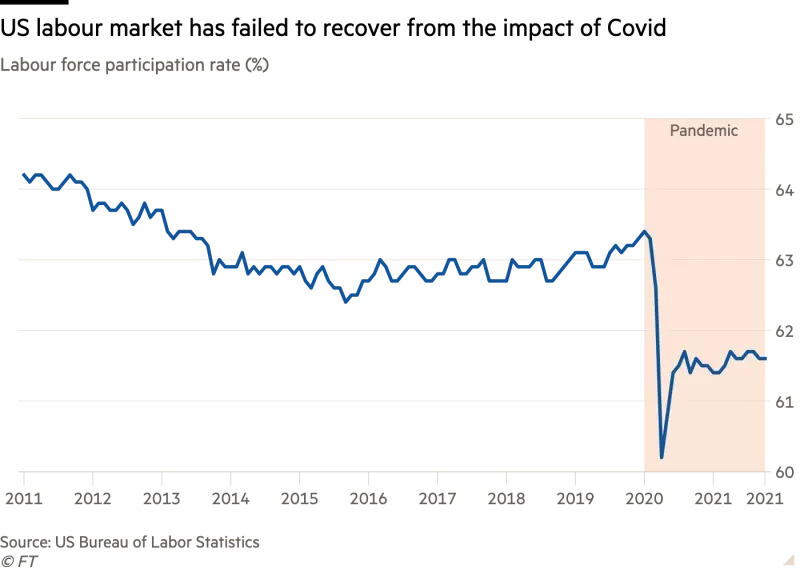

Two years of unprecedented upheaval in labour markets has caused millions of people on both sides of the Atlantic to step out of the workforce, whether to avoid infection, recover from illness, cope with school closures, or simply to retire earlier than they might otherwise have chosen. The drop in participation has added to demographic pressures that were building long before the pandemic hit — and have since been exacerbated by the slump in international migration.

This shock to labour supply represents a threat to the global recovery, with many companies forced to turn away business for lack of workers. While companies hoped these problems would be transitory and would ease over the summer after economies reopened, many now worry that the issues may be more deep-seated.

It also creates a dilemma for central banks just as inflationary pressures are rising and financial markets are getting rattled. For the US Federal Reserve in particular, dropouts from the labour market cast doubt on its ability to hit its goal of “maximum employment” while still containing inflation.

Aneta Markowska, chief economist at Jefferies, argues that a “structural decline in labour supply, coupled with unprecedented labour demand . . . will create the tightest labour market conditions in decades”. That would keep wage growth high and inflation above the Fed’s target, even when supply chains have recovered, forcing the central bank to reframe its maximum employment goal.

Now, with demand surging and labour shortages spreading, many of those who have worked through the pandemic are gaining the confidence to quit their jobs and bargain for higher pay or better conditions elsewhere. But as Nick Bunker, North American research director for the job site Indeed, points out, the so-called Big Quit is mostly about churn within a shrunken pool of existing employees in low-wage sectors where employers used to hire readily from the pool of unemployed.

The crucial question is whether those workers now standing on the sidelines will rejoin the labour force — or whether employers, consumers and policymakers will need to adapt to a world in which labour is scarce. As Jason Furman, a senior fellow at the Peterson Institute for International Economics, puts it: “The biggest wild card is not the strength of demand or desire of employers to hire, but the desire of workers to find jobs”.

The question is most urgent in the US, where more than 4m workers have left the labour force since the start of the pandemic and the participation rate is still stubbornly 1.7 percentage points below its level in early 2020 — which is the equivalent to more than four million people. Similar pressures are visible in the UK, where the Institute for Employment Studies estimates that, due to a combination of population change and higher economic inactivity, there are now almost a million fewer people in the workforce than there would have been if pre-pandemic trends had continued.

“Labour supply just cannot keep up with labour demand, and the problem appears to be getting worse”, said Tony Wilson, director of the IES, adding that inactivity in the UK seemed to be increasingly driven by ill health and early retirement.

In the eurozone, in stark contrast, employment has almost regained its pre-pandemic level and labour force participation has rebounded rapidly — so that in France and Spain it is already higher than it was before the crisis.

Although rising demand is starting to create pressures, there is still a large pool of untapped labour in the bloc, with participation lagging in Italy, and many countries suffering from structurally high youth unemployment — the legacy of the 2008 crisis. The EU has seen no wave of early retirements during the pandemic because in many countries this is already the norm.

But Claus Vistesen, at the consultancy Pantheon Macroeconomics, says investors are now “hoping that this deficit can be turned into potential”, especially in Italy, where Mario Draghi is pressing for pension reforms.

Meanwhile Philip Lowe, governor of the Reserve Bank of Australia, argued last week that inflation could be less problematic there than in the US, because labour participation was returning towards record highs, in common with Japan and other countries in the region, with little pressure on wages.

He argued that the difference was due to the high incidence of infection in the US, to school closures and to its policy of channelling income support directly to workers, rather than through schemes that preserved links between businesses and employees. “The result has been a significant shock to labour supply in the US. This has not been the case in Australia”, he said.

Yet while the situation differs from one country to another, there are some common themes. One is the role played by migration.

In the UK, while labour shortages predate Brexit, they have undoubtedly been exacerbated by the sudden stop in inflows of EU workers. In the eurozone, labour shortages are most visible in Germany, which previously relied on a steady inflow of migrants to replace an ageing population. Diane Swonk, chief economist at the audit firm Grant Thornton, says the US is now “two million people short of where we should be” due to restrictive immigration policies in place since 2016, even before the pandemic closed borders. “It’s very hard to make up the gap in ageing demographics without a major catch-up in immigration”, she says.

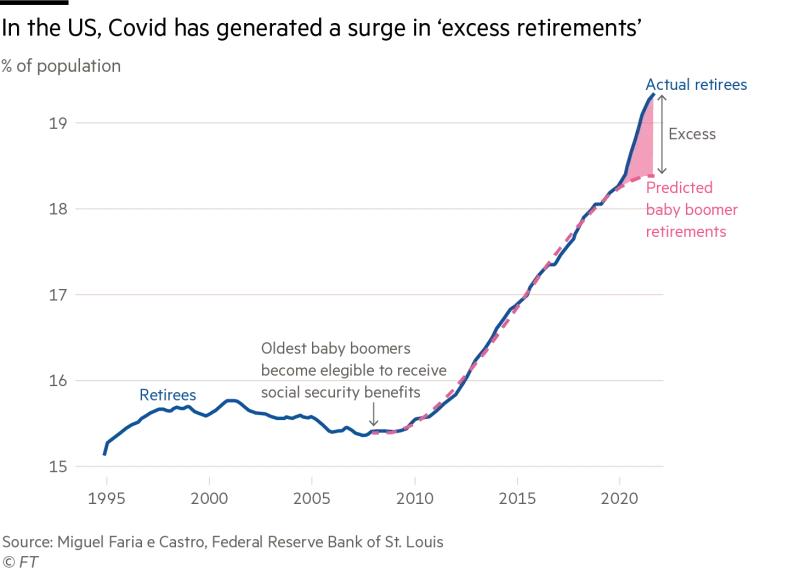

Another big factor in the US and UK has been a swath of early retirements — a sharp reversal of the pre-pandemic trend for people to stay in work for longer. The Federal Reserve Bank of St Louis estimates that excess retirements — those that would not have happened through natural population ageing — totalled some 2.4m from the start of the pandemic up to August, accounting for more than half of those who left the labour force.

Some older workers will choose to return as health worries subside and financial strains start to build, but many will not.

“The idea was: let’s do things while we still can”, says Monique Hanis, who retired in July from her role as a communications executive with a clean energy policy firm in Washington DC. Her husband was already retired, but Hanis, aged 60, was still passionate about her job — until the Covid crisis isolated her from colleagues and an unrelated health scare made her long for freedom. Since retiring, she has already received one job offer but has no plans to rejoin the workforce. “There seems to be some demand for experienced people, but I would not go back full time”, she says.

In contrast with previous recessions, there are fewer people who feel they have been forced into retirement by a lack of job options, and more who have seen rising asset prices open up choices.

The surge in house prices has made gains in wealth more broad-based, Swonk says, adding: “You can sell, borrow against [property] or trade down into a condo — the ability to do that was absent before. In 2008/09, you would have been underwater”.

In the UK, too, some people have found themselves newly able to afford retirement and less able to tolerate working conditions that had worsened due to Covid.

Ken Scott, a 64-year-old HGV driver in Nottinghamshire, says Covid really “sunk it home” how badly drivers were treated, with public toilets and roadside burger vans closed so that “you couldn’t even get a hot drink”. Supermarkets that had previously kept drivers “in a little room on cheap plastic chairs” while trucks were loaded suddenly demanded that they stayed in their cabs.

He had already scaled back before the pandemic, he says, after a military pension earned from 25 years in the marines kicked in. But he now sees other drivers in what is a former mining area doing the same: many of them had trained and joined the sector at the same time in the late 90s, when the last mines closed, and were now eligible for pensions from their previous careers.

In the US, greater financial freedom is one factor behind the drop in the prime age workforce too. This does not seem to be about the generosity of pandemic-era jobless benefits, which expired in September without any noticeable change in labour force participation. But a survey of unemployed workers by Indeed found that most were not looking for a job with any urgency — and that many of them said this was because they had a cushion of savings, or a partner in work who was earning.

There has also been a drop in the number of Americans holding more than one job — a problem for employers, but a positive trend that suggests rising wages are making it easier to make ends meet.

However, surveys also show that many workers are still deterred by fears over Covid and ongoing difficulties with childcare. Although schools have reopened, they are still disrupted by quarantines and the workers who staff afterschool clubs can now find better pay with Amazon or Walmart.

Janet Yellen, the US Treasury Secretary, argues this means workers will trickle back as concerns over exposure to Covid subside. “When we really get control of the pandemic, I think labour supply will go back to normal”, she said in an interview for CBS’s Face the Nation programme last week.

Patrick Harker, president of Philadelphia’s Federal Reserve Bank, made a similar argument to the Economic Club of New York this month, adding that financial pressures could soon prompt people to return. The end of extra benefits had not yet “nudged” people back into the workforce, but “I do expect that will change eventually, and especially as other forbearance programmes run out”, he said.

Joseph Briggs, an economist at Goldman Sachs, says he expects most prime-age missing workers to reappear gradually, but that participation could still be below its pre-pandemic trend at the end of 2022, with higher wealth prompting more early retirements. The surge in popularity of Reddit’s Antiwork message board suggests a longer-lasting shift in preferences and lifestyles among some, he adds.

In the UK, while the Bank of England’s central forecast is for a recovery in the labour force, it has flagged up the risk of a more persistent fall in participation due to lingering health concerns and long Covid, and to rising numbers retiring early.

The bigger long-term issue, though, is demographics — and recruiters are gearing up for a future in which they will need to do far more to help people on the margins of the labour market into work.

“Will it get better? Probably not . . . In the long term it’s the same for every country”, says Jacques van den Broek, chief executive of Randstad, a staffing provider with operations across North America and Europe. He argues that companies need to become more open to recruiting and training people who only partly match their criteria, and to tap rural areas where workers are still available.

Neil Carberry, chief executive of the UK’s Recruitment & Employment Confederation, thinks the upheaval caused by switching the economy on at speed will soon ease, but that the UK will see both a steady outflow of EU nationals and a much bigger, lasting hit to labour supply as the baby boomer generation reaches retirement.

He adds: “The immediate crisis will pass, but we are looking at a decade of a tighter labour market”.

By Delphine Strauss. Additional reporting by Taylor Nicole Rogers in New York.